I think these cheap FTSE 100 and FTSE 250 shares might be too good to ignore. Each trades on a rock-bottom, forward-looking price-to-earnings (P/E) ratio.

This is why I’d buy them if I had spare cash to invest right now.

Centamin

Earnings at gold miner Centamin (LSE:CEY) are highly sensitive to the price of the commodity that it produces. Sinking bullion values could therefore have disastrous implications for shareholder returns.

Yet I believe safe-haven demand for the yellow metal could pick up sharply. Gold remains perched around the $2,000 per ounce marker and is looking in good shape to strike new record peaks.

There are multiple reasons why precious metals prices could spike again, including:

- Growing pessimism surrounding the global economy

- Rising geopolitical tension (like widescale conflict in the Middle East and fresh US-Chinese tensions)

- Persistent inflationary pressures

- Looser monetary policy by central banks to boost growth

- Continued weakness in the US dollar

Buying a share based on near-term gold price movements is risky business. So I need more to encourage me to invest.

In Centamin’s case, I’d also buy the company for its portfolio of production assets. At its flagship Sukari mine in Egypt, the firm hopes to produce 506,000 ounces of the yellow metal each year between 2025 and 2034. It is also targeting all-in sustaining costs below $1,000 per ounce under a new life of mine plan.

The miner also has a string of exciting early-stage projects in its stable. This includes the Doropo complex in the Côte d’Ivoire where pre-feasibility testing is scheduled for mid-2024.

Today Centamin shares trade on a forward P/E ratio of eight times. They also carry a meaty 3.8% dividend yield — readings I think make the company highly attractive.

JD Sports Fashion

Sportswear retailer JD Sports Fashion (LSE:JD.) is another value stock on my shopping list. That’s despite an uncertain near-term outlook as consumer spending remains under pressure.

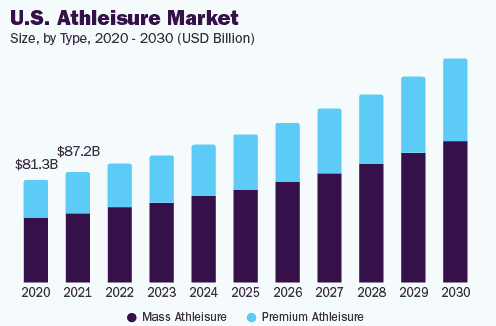

I think the FTSE 100 firm could deliver titanic profits growth as it acts to capitalise on the ’athleisure’ boom. City analysts are tipping earnings to rise 13% and 12% in the financial years to January 2025 and 2026 alone.

JD is exploiting this opportunity by rapidly building its store network through new openings and acquisitions. The company — which has operations across Asia, Europe, and North America — hopes to open 250 to 350 stores every year through the next five years.

Though it operates in a highly competitive industry, its focus on the premium end of the market, along with the exclusive stock agreements it signs with the world’s major sportswear companies, make it the place to go for fashion-conscious shoppers. This gives it an obvious advantage.

In fact, as the chart above shows, the premium athleisure segment in its US market is tipped to grow ahead of the broader market, suggesting JD could be the best way to exploit this growing market.

Today JD shares trade on a forward P/E ratio of 11 times. I think this makes it a bona-fide bargain.